Hidden inefficiencies in Mergers & Aquistions due to outdated processes cost merger parties over $5B each year in the United States, or approximately $500K per deal. These costs are the result of slow payments, poorly invested funds held in escrow, manual processes, unnecessary complications and administrative hassle. SRS Acquiom is eliminating these inefficiencies by making the process of closing M&A transactions faster, simpler, and more economical for deal participants and their attorneys.

M&A Transactions Hidden Inefficiencies

In most merger transactions, the parties are well served by their professional representatives such as lawyers, bankers and accountants. Each adds considerable value to the M&A deal process. However, the M&A industry contains numerous hidden inefficiencies that cost deal parties billions of dollars per year in real out-of-pocket expense as well as opportunity costs. Many of these inefficiencies receive little to no

attention because they may not seem large on a single deal. The result is that this waste has gone unaddressed for decades. In a market where buyers, fund managers and sellers are struggling to maximize returns, and lawyers are continuously looking for ways to add value for their clients, it is imperative that this fat in the system gets trimmed.

This paper provides an analysis of these inefficiencies and their cost to the industry as a whole. The first two inefficiencies — slow payments and poorly invested escrows — account for virtually all of the dollar costs. The other inefficiencies, while smaller in dollar terms, add up to huge amounts of needlessly wasted time and effort.

Size of U.S. M&A Market

In the United States, each year there are approximately 10,000 private M&A transactions with a disclosed aggregate value of $1,000B1. An analysis of SRS Acquiom data indicates that doubling disclosed value produces a reasonable estimate of actual value,2 for an estimate of total aggregate deal value of $2,000B annually. Sources indicate that 75% of transaction consideration is paid in cash;3 therefore approximately $1,500B in cash payments are made annually.

The 2014 SRS Acquiom M&A Deal Terms Study reveals that for the typical deal, approximately 10% of transaction value is held back in escrow for a period of 18 months. Applying 10% and 18 months to $1,500B yields an estimate of $225B held in escrow at a given point in time.

Inefficiency: Slow Payments

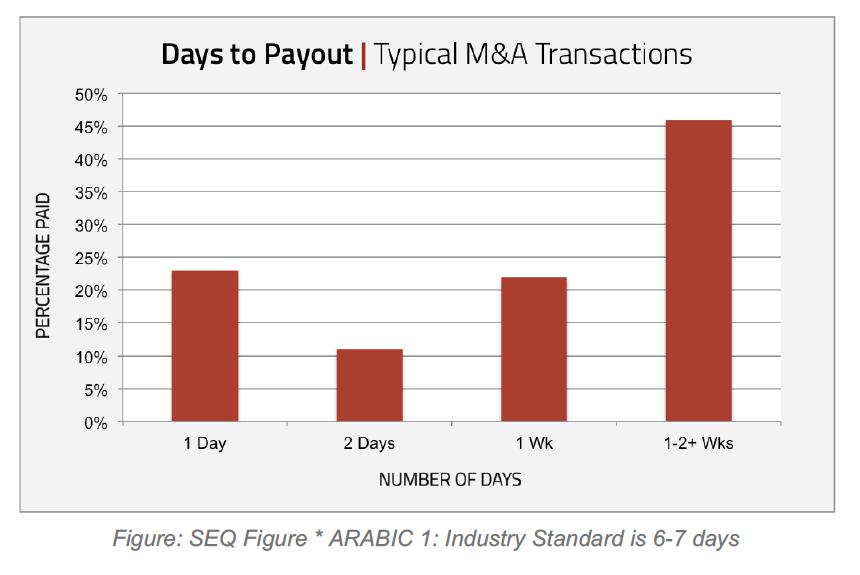

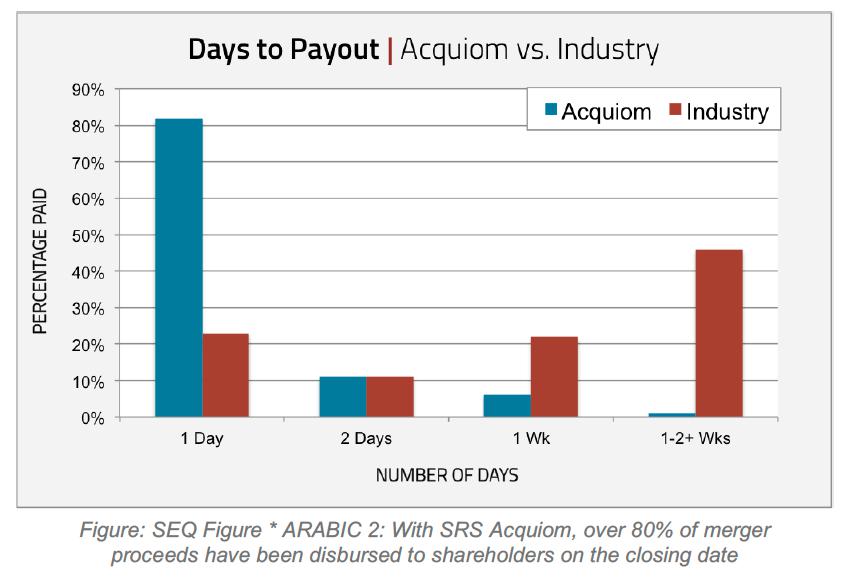

Everyone understands that it would be better to get paid as soon as possible, but many deal professionals simply assume it takes a week or two to effect payments following the closing of an M&A transaction or the expiration of an escrow. Most investors are looking to realize a 20% or higher internal rate of return on investments in private companies, so the cost of capital is high4. Assuming annual cash payments of $1,500B, then each day that M&A payments are delayed costs the industry over $800M. According to SRS Acquiom data, the average time for banks to pay closing consideration has been six days. That means that the value to investors of eliminating this delay is approximately $4.9B per year — a huge opportunity cost that warrants serious attention.

SRS Acquiom solves for this. SRS Acquiom Clearinghouse, the industry’s first online M&A payments administration service, allows paperless and easy submission of all materials. The online Letter of Transmittal (LOT) is simple and intuitive, in contrast to complex and confusing paper LOTs that are a significant cause of delays and a major source of customer support calls. Incomplete paper LOTs are rejected and mailed back, and by the time the shareholder corrects the discrepancy and returns the LOT weeks can pass by. Often a shareholder has no idea that there is an issue, so they have to call to find out why they haven't been paid, tying up more resources unnecessarily.

Another issue is that many paying agents are frustratingly inflexible when it comes to modifying agreements or payment schedules. Most banks insist on a precisely formatted spreadsheet that requires counsel to manually transfer data from one spreadsheet into the bank’s format — a process that is frustrating to counsel because they view their source spreadsheet as perfectly suitable. Transcribing data is labor intensive,

error-prone and a needless waste of time and money. By moving M&A payment administration online, SRS Acquiom Clearinghouse eliminates transcription errors, and the whole process is streamlined with simple, more intuitive forms. The result is faster payments to shareholders and no hassle for acquiring companies. To date, over 80% of merger consideration has been paid the day of closing:5

Hidden cost of slow payments: $4.9B.

Solved by SRS Acquiom: Yes.

Inefficiency: Poorly Invested Escrows

On most deals, rarely does anyone pay attention to how the escrow is invested. As a result, these funds are among the least efficiently managed asset classes. While preservation of capital and liquidity are primary objectives for clear reasons, interest rates on escrow deposits over the last several years have been only a few basis points at best. On most transactions there is little to no consideration of whether it is possible

to achieve better yields via alternative investment options. While it is not practical to drive venture-like or private equity-type returns from an escrow, each basis point of additional yield that can be achieved is worth approximately $22.5M to the industry annually.

SRS Acquiom solves for this. Data from 600 M&A transactions have been used to create financial models of how M&A escrow accounts actually behave. Most funds are held in escrow for the full duration of the escrow period, and when claims are made, these take months to resolve. Putting these models into practice, SRS Acquiom distributes enhanced escrow solutions that offer much higher yields and provide immediate liquidity that is a top priority. Assuming a yield of an additional 15 basis points, the opportunity to the industry is on the order of $340M per year.

Hidden cost of poorly invested escrows: $340M.

Solved by SRS Acquiom: Yes.

Inefficiency: Stock Certificates and Paper Closings

For decades, deal closings have been completed by mailing piles of paper — letters of transmittal, information statements, transaction documents and stock certificates — back and forth between the merger parties, the stockholders and a paying agent. As with the other inefficiencies, the costs of printing and mailing have gone largely ignored. While not a huge number, the average hard dollar cost for distributing documents to shareholders is estimated to be approximately $2,250 per deal6, which does not take into account the hassle, wasted time and inconvenience for stockholders to complete the paper process, or the negative environmental impact. All this paper adds to the burden felt by administrative teams that are already stretched thin and are aggressively looking for ways to operate more efficiently.

Additionally, in most transactions there is no legal need for the merger parties to collect stock certificates from selling stockholders. UCC §8-207 provides extensive protection to an issuer or buyer that makes a distribution to a registered owner of the securities in a merger even if the registered owner is not the true holder of the security, so long as no other person has presented the security for transfer. A comment to this section states, “The issuer may under this section make distributions of money or securities to the registered owners of securities without requiring further proof of ownership . . .” UCC § 8-207, Comment 1 (emphasis added). The comment goes on to make clear, “The issuer may under this section make distributions of money or securities to the registered owners of securities . . . Any such distribution shall constitute a defense against a claim for the same distribution by a person, even if that person is in possession of the security certificate and is a protected purchaser of the security.” UCC § 8-207, Comment 1 (emphasis added). Despite this, many banks for years have required stockholders to submit affidavits of loss and pay surety bonds if they are unable to deliver the original stock certificate. In addition, requiring original stock certificates to be mailed back to the paying agent contributes at least two days to the opportunity cost attributed to payments delays and is a major impediment to eliminating the inefficiencies attributable to slow payments.7

Primarily due to the simple reason that paper is used, industry service level agreements for processing payments are typically 3-5 business days after receipt of a paper LOT. Errors made when entering and transcribing data compound the problem. We estimate that the aggregate cost of unneeded bonds plus printing, copying, and mailing paper documents may approach $100 million per year. SRS Acquiom Clearinghouse solves for this by allowing selling shareholders to submit all information via a secure online platform that is quick, easy, and intuitive.

Hidden cost of using paper: $100M

Solved by SRS Acquiom: Yes.

Inefficiency: M&A Payment Methods

There are good reasons why parties would sometimes prefer that a payment is made by check or wire, but often a cheaper method is available that is never considered. Automated Clearing House (ACH) payments are credited to bank accounts next morning prior to bank opening hours, and cost just pennies, a fraction of the cost of a check or wire payment. For a transaction with 50 selling stockholders and two rounds of payments (closing and escrow release), the cost savings of paying by ACH can be thousands of dollars. Industry-wide, this adds up to tens of millions spent on making payments in a way that may not be necessary.8

Hidden cost of expensive payment methods: $26M

Solved by Acquiom: Yes.

Conclusion: Hidden Costs Exceed $5 Billion Annually

Each M&A deal is unique and some opportunities to eliminate inefficiencies may not be available on a particular transaction. For instance, there might be good reason to place a deposit into an interest-free account or to make a payment by check. Deal practitioners should, however, consider the administrative alternatives available when advising their clients and challenge existing assumptions regarding the way administrative tasks have historically been handled.

Changing the default way that many of these issues are handled has the potential of delivering well over $5B of additional value to clients while easing the administrative burden of completing the closing process. If we assume approximately 10,000 transactions per year, the savings average approximately $500,000 per deal.

SRS Acquiom is innovating new ways to complete M&A transactions that eliminate these inefficiencies and greatly improve the economics. The combination of SRS Acquiom payments administration services and escrow solutions solves for the $5B inefficiency in M&A today.

Footnotes

1 Sources: e.g., William Blair Merger Tracker M&A Markets Analysis Q4 2013, p. 8; S&P Capital IQ; SRS Acquiom market analysis.

2 The values of the majority of deals are not disclosed publicly. An analysis of the 600 private M&A transactions on which SRS Acquiom has been engaged indicates that doubling disclosed value produces an estimate of actual total deal value.

3 Sources: e.g., William Blair Merger Tracker M&A Markets Analysis Q4 2013, p. 15; Houlihan Lokey Purchase Agreement Study, For Transactions Completed in 2012 and Prior Years; SRS Acquiom market analysis.

4 We do not assume investors will reinvest the funds for a few days at a rate of return of 20%. Rather, this is the overall rate of return investors typically expect in private company investments, so the timing of cash flows related to those investments accrues at a 20% internal rate of return.

5 100% of payments are made the first day when payment instructions have been received and merger consideration is in the payment account.

6 Conservatively assuming 7,500 deals per year (75% of 10,000) have at least a portion of the merger consideration paid in cash and 50 shareholders per deal, we estimate the costs of printing, copying, mailing, and overnight shipments of paper documents to be $2,250 per deal, or nearly $17 million. This is based on an assumption of an average of 100 pages per mailing at a cost of $0.05/page and $20 overnight shipping charges for two mailings per shareholder.

7 For stock certificates, conservative assumptions have been made, based on discussions with industry sources and SRS Acquiom experience on 600 private M&A transactions:

- 25% of deals require at least one significant shareholder to purchase a surety bond due to lost paper stock certificates = 2,500 shareholders purchasing surety bonds.

- Assume cost of bond is 3% of a payment that is $1M on average = $30K average cost per bond

- 2,500 x $30K = $75M per year.

8 Assuming 7,500 deals per year as set forth above, 50 shareholders per deal, two rounds of payments per year, and $35 payment method fees, then the total cost for payments by wire and paper check exceed $26M annually.