Topic

Format

Deal Terms Analysis

2026 Working Capital Purchase Price Adjustment Study

Tools for Practitioners

SRS Acquiom BarometerTM:

2026 M&A Outlook

Loan Agency

Europe’s Loan Market Eyes Emerging Markets and Regulation as Next Opportunities

Loan Agency

U.S. Credit Markets Outlook

Loan Agency

European Credit Markets Outlook

Deal Terms Analysis

M&A Deal Terms: Three Trends to Watch in 2026

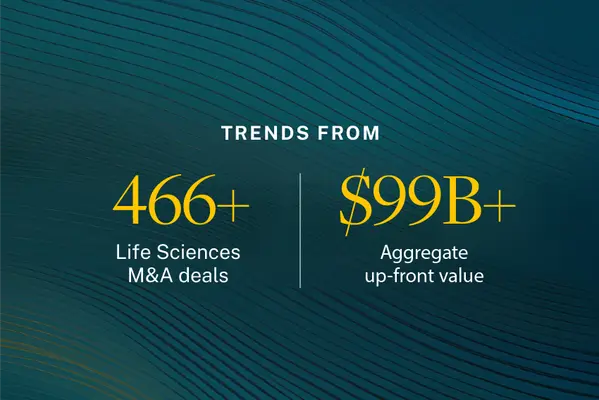

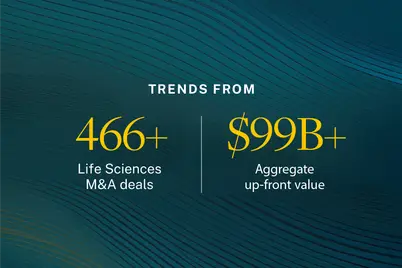

Deal Terms Analysis, Life Sciences

2025 Life Sciences M&A Earnout Achievement: Key Findings by Industry Sector

Loan Agency

The ABCs of LMTs: Liability Management Transactions and What You Need to Know

Shareholder Representation

Expense Funds for the Win-Win

Deal Terms Analysis

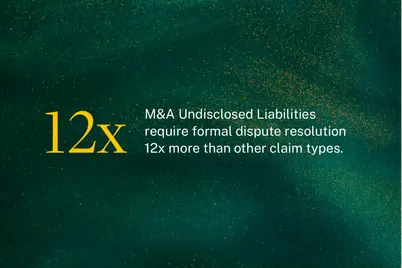

2025 Update: M&A Undisclosed Liability Claims and Earnout Achievement

Deal Terms Analysis, Life Sciences

2025 SRS Acquiom Life Sciences M&A Study

Loan Agency

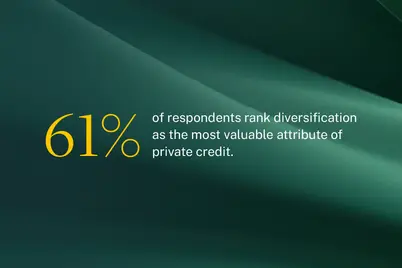

Credit Markets Outlook: Examining Trends in Private Credit and Broadly Syndicated Loans Across the U.S. and Europe

Shareholder Representation

M&A Tax: Key Considerations for Mergers & Acquisitions in 2025

Deal Terms Analysis

2025 M&A Deal Terms Special Report: Lower Middle-Market Deals

Indemnification

Why Are M&A Deal Parties Thinking Twice About RWI?

Loan Agency

2025 Insights from the Rise of Private Credit

Deal Terms Analysis, Indemnification

2025 Special Report: Influence of RWI on M&A Deal Terms

Due Diligence

Best Practices in M&A Due Diligence

Deal Terms Analysis, Indemnification

Deal Terms for M&A Escrows - Statistics and Key Findings

Deal Terms Analysis

M&A Deals: Key Trends and Highlights from the SRS Acquiom M&A 2025 Deal Terms Study

Loan Agency

Loan Liquidity Allows Accessibility: What You Need to Know

Shareholder Representation

Does Your M&A Deal Need a Professional Shareholder Rep?

Loan Agency

Trends in Loan Agency and Regulatory Compliance

Deal Terms Analysis

2025 M&A Deal Terms Study