M&A escrows are often part of an M&A transaction. Escrow arrangements benefit both parties, but M&A buyers especially benefit from understanding what escrows are, why they are important, and how they can be used to mitigate deal risks in increasingly complicated transactions. Here, we share an overview of this important topic with baseline information about M&A escrows.

What is an escrow?

An escrow is when cash or other assets (such as stock) are held back from the purchase price of a transaction for a specific purpose. The holdback assets are kept safe by a neutral third party (usually a bank) for a period of time or until certain conditions are met. During the escrow period, agreed claims are paid from the escrow assets. At the end of the term, any remaining assets are released as previously agreed. Escrows are used in many different types of sales transactions, including M&A, real estate, investment deals, and pension schemes, and are a “tried and true” risk mitigation device.

While escrows held by a third-party are most common, sometimes the buyer holds the funds. In those cases, the funds are referred to as a “holdback.” Holdbacks and escrows are meant to accomplish the same purpose. This article combines escrow and holdback data together and focuses on the escrow structure, but it is important to note that, in practice, holdbacks can give buyers additional leverage when negotiating post-closing claims or releases since they directly control the funds.

M&A escrows benefit both buyer and sellers

Why would an M&A buyer want an escrow?

- Escrows provide identified assets that can be used to secure future payment of the seller’s post-closing obligations and mitigate collection risks. They are particularly helpful if there are numerous selling shareholders and in cross-border transactions because collecting claims from many parties or a party in another country can be challenging and expensive.

- M&A transactions are often viewed as risky by buyers due to many unknowns in an increasingly complex deal environment. Prudent buyers want options to recover post-closing claims and losses. Holding back a portion of the purchase price is one tool to incentivize the seller to be transparent about uncertainties and risks within the business so the parties can take them into consideration when negotiating the deal. If the seller does not meet its obligations under the purchase agreement, the seller forfeits some or all the escrow assets at the end of the escrow period.

Why would an M&A seller want an escrow?

- An M&A escrow can expedite the due diligence process and reduce the cost and schedule of the transaction. Having assets set aside to cover claims that may arise after the deal closes lessens the pressure on the buyer to turn every rock to uncover potential gaps.

- An escrow provides more certainty of the minimum proceeds the seller will receive from the deal. An escrow often replaces the buyer’s rights to claw back payments made to the seller. If seller’s liability for non-fundamental breaches is capped at the escrow amount, seller has no liability beyond the escrow amount. Also, if claims made are less than the escrow, seller will be paid the remainder.

Use the due diligence process to identify risks

M&A escrow requirements track what the M&A due diligence process reveals about the target business. If the due diligence process identifies irregularities, gaps or uncertainties, those risks can be addressed by one or more escrows or other risk mitigation tools. Due diligence topics include identifying risks in the following areas: financial, operational, employment, legal, and regulatory (including litigation, environmental and other compliance risks), intellectual property, and, increasingly, cybersecurity and other emerging technology matters. The SRS Acquiom due diligence checklist offers greater detail about the due diligence process.

Which risks can an M&A escrow address?

Escrows can address any risk identified in the due diligence process, but they are generally used to address the most significant risks identified. An escrow can provide funding for seller’s general indemnity obligations, one specific risk, or a variety of potential risks. How many escrows and which risks to address is deal specific.

For example, most M&A deals have a working capital purchase price adjustment mechanism of some kind. If an adjustment after closing determines the purchase price paid was too high, an escrow is often used to reimburse the amount of overpayment.

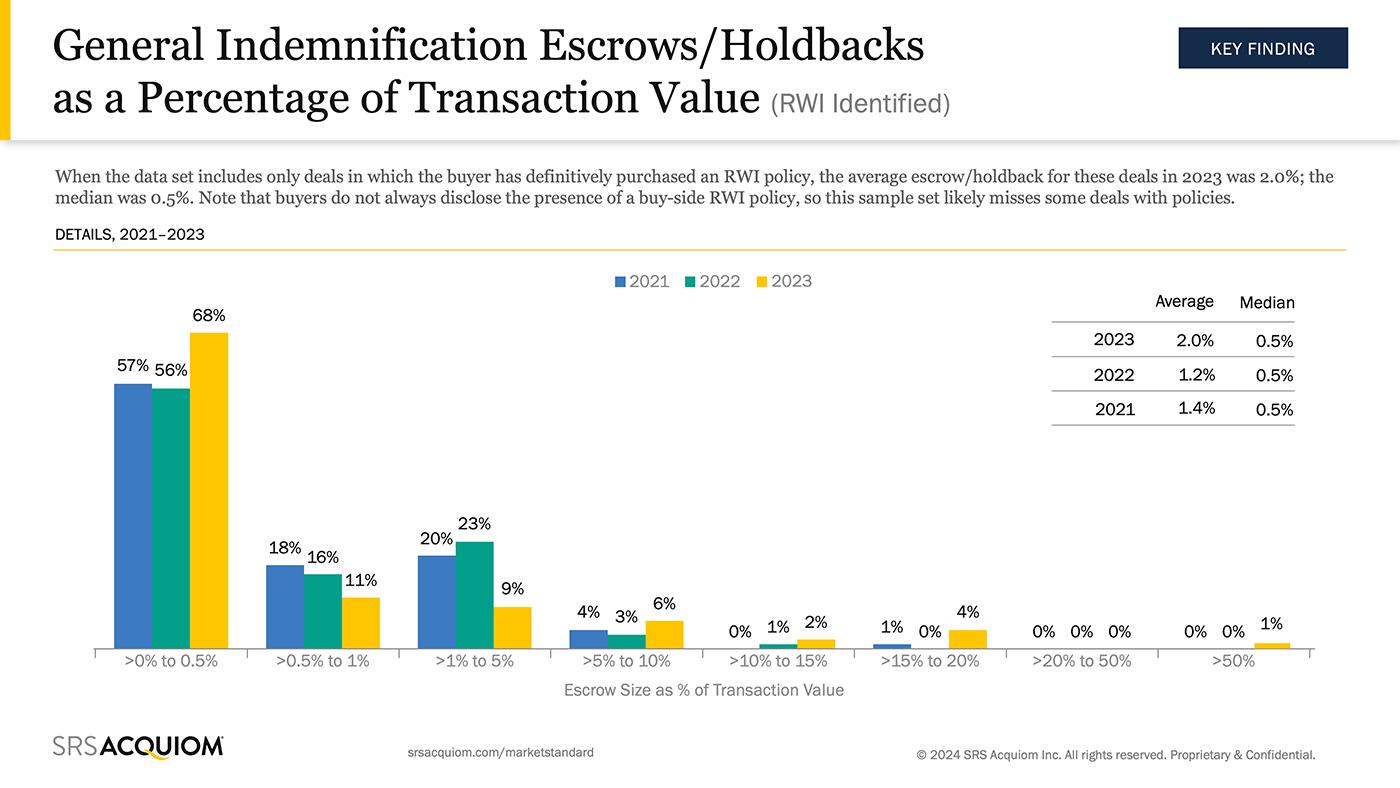

Do escrows replace Reps & Warranties Insurance (RWI)?

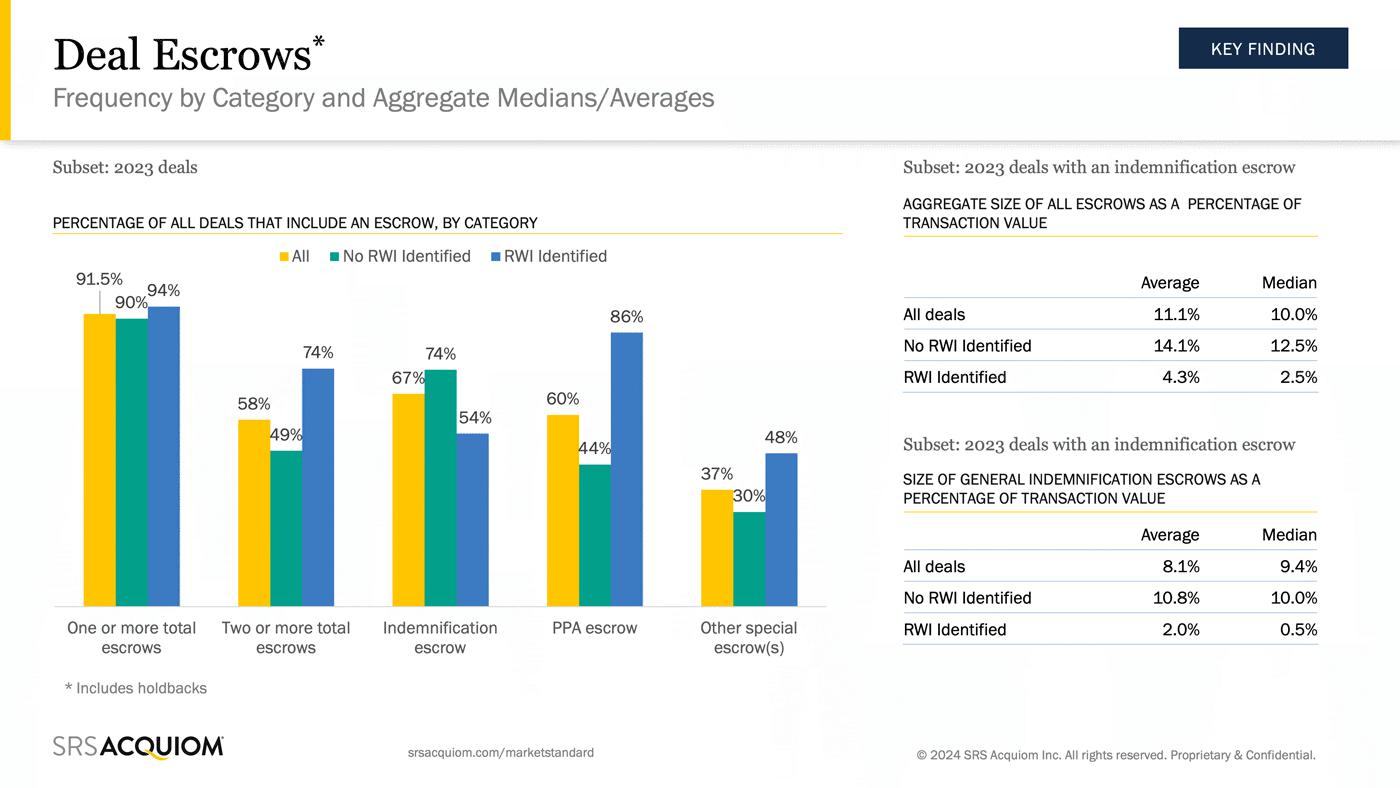

Escrows and RWI are two different risk management tools, although almost all deals with RWI also have an escrow. RWI does not usually replace the escrow, but the presence of RWI may decrease the amount or duration of an escrow. Generally, the escrow covers the RWI retention (deductible amount) that must be met before coverage begins and any policy limitations, exclusions and caps.

RWI aims to shift potential liability to an insurance company, subject to an insurance claims process, which adds time and complexity to post-closing indemnification claims. An escrow makes a certain amount of assets available for collection purposes as mutually agreed by the parties. Sellers will often appoint a shareholder representative to work with the buyer directly on any post-closing claims. An experienced shareholder representative can streamline resolution of claims.

However, both RWI and escrow accounts have cost and administration burdens, which must be considered when deciding if one, or both, tools will be used. Learn more about the impact of RWI on M&A deals.

Starting the M&A escrow process

M&A deal parties should first determine the risks to be addressed by escrow, the number of escrows, the amount to be held in each escrow, and how many claims or distributions are likely to be paid. Those details are helpful when selecting which escrow agents, paying agents, and other service providers are best suited to the deal, and determining what the various agreements with them should address. Careful selection of M&A service providers and negotiating the escrow agreements is critical. This article provides general information about M&A escrows and issues to consider. Learn more about efficient management of escrows and how to keep your deal running smoothly.

How much is the median escrow?

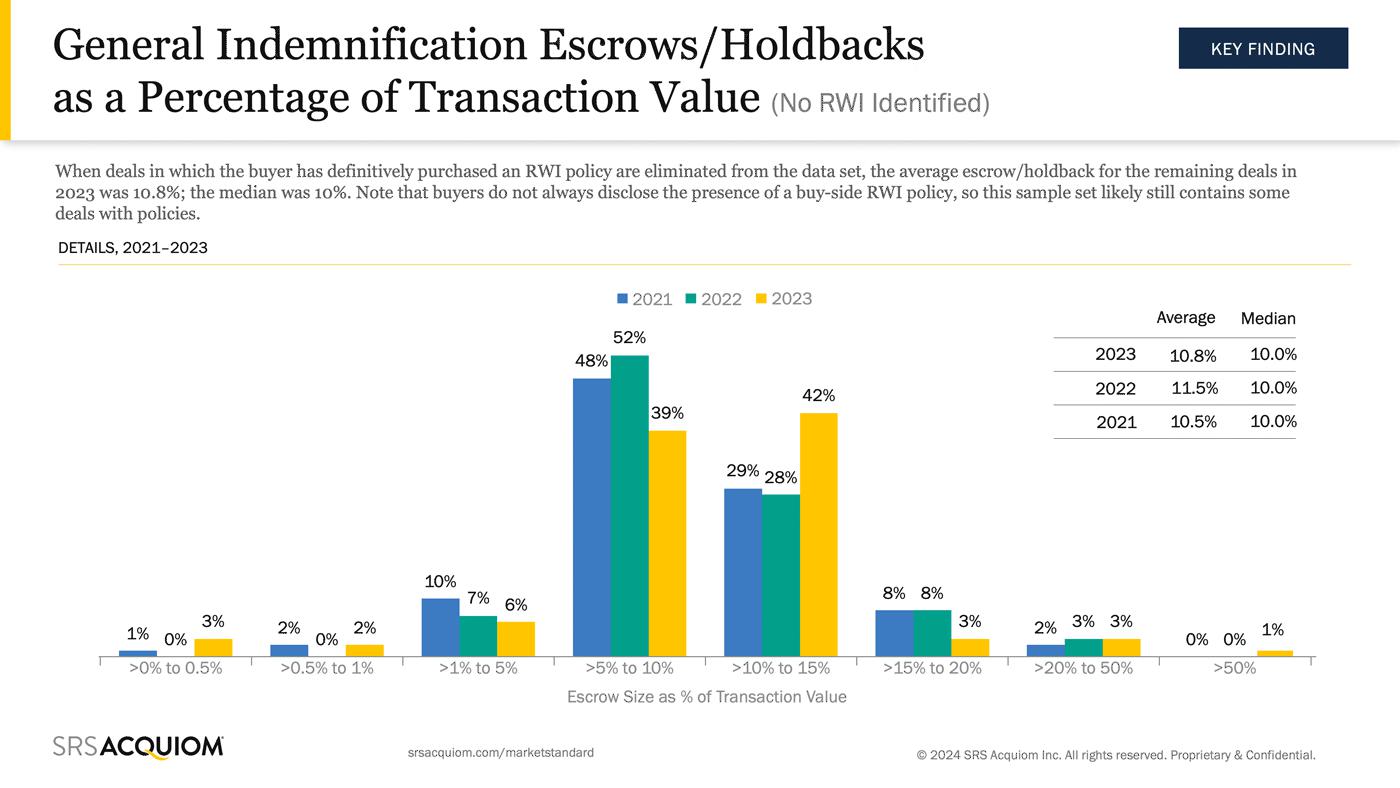

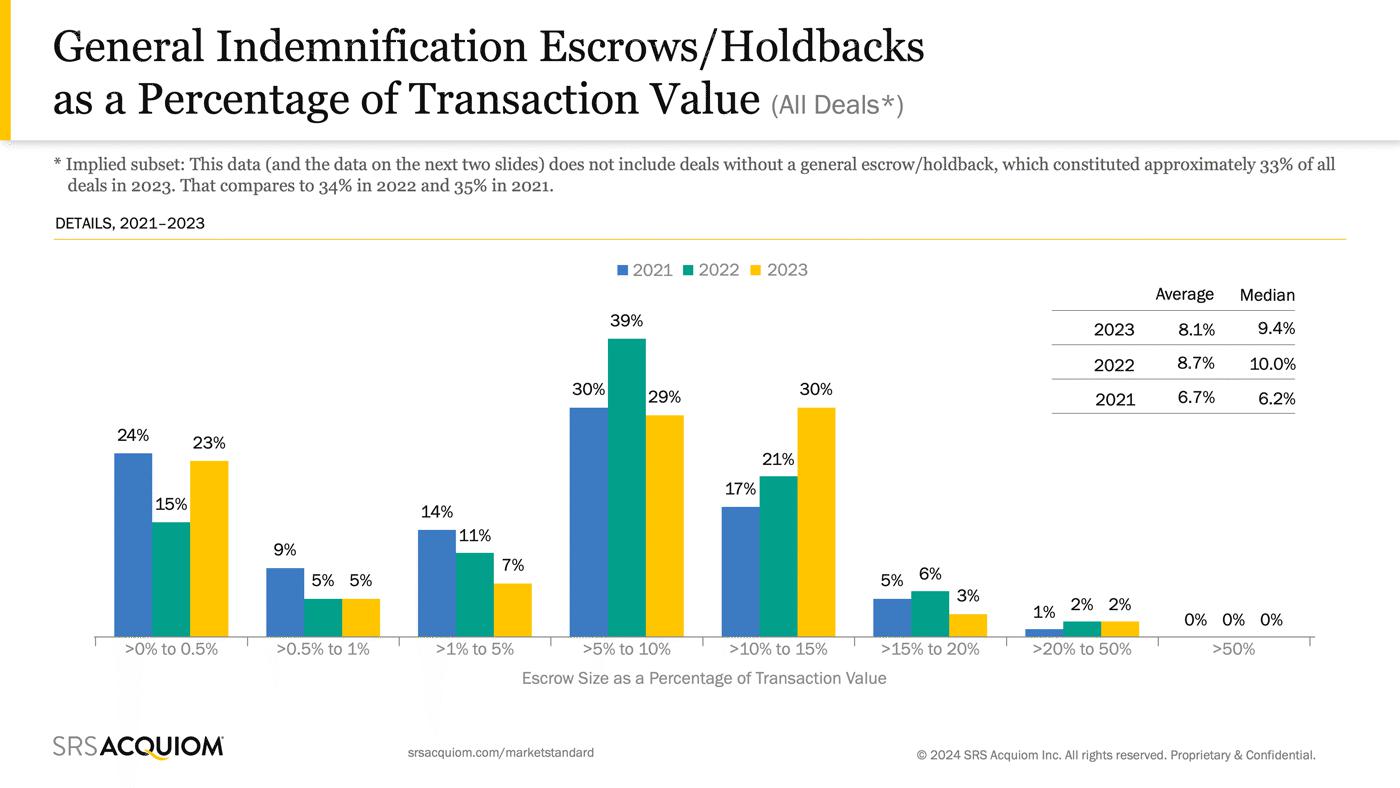

The amount depends on the value of the deal, the number of significant risks identified, and other potential sources of security or offset. A holdback of 10% or more of the purchase price is common, but negotiable. A general indemnification escrow, if no M&A insurance is used, often approaches 10%.1

The amount agreed by the parties can be held in one escrow or allocated between multiple escrows. Multiple escrows may be used if the seller does not want a large general escrow to be retained because one small claim has not been resolved or if the parties agree different liabilities and risks should have different payout procedures or amounts allocated to them. Often one general indemnity escrow, in an amount sufficient to address the key risks, along with some form of M&A insurance, is sufficient risk management, but not always. Based on research at SRS Acquiom, in 2023, 90% of deals had at least one escrow, but more than half had two or more.1

What is a common escrow period?

The duration of an M&A escrow generally matches the warranty period for the identified risk. This gives the buyer time to operate the business, verify if the seller’s representations and warranties were accurate, and determine if there are any warranty claims. A duration of 12 to 18 months is common, but is usually dependent on buyer’s due diligence efforts and findings.

How is an M&A escrow established and managed?

If at least one M&A escrow is included in the deal, the parties must identify the players, their roles, and how the escrow amounts will be managed and paid out. Choosing the right third-party escrow agent is important as they will act as an integral partner in finalizing the escrow agreement, opening the escrow account, and otherwise shepherding the parties through the escrow period. The escrow arrangement is governed by an escrow agreement, an ancillary agreement to the M&A transaction.

Who are the players in M&A escrow management?

- The escrow parties always include the buyer, the seller (or an appointed seller shareholder representative) and the escrow agent. All escrow parties are required to negotiate and sign the escrow agreement, the escrow release instructions, and complete know-your-customer requirements to open the escrow account. If the seller appoints a shareholder representative (“SHR”), the SHR acts on behalf of the seller shareholders, signs the escrow agreement and instruction letters, and oversees the post-closing claims process for the seller.

- The escrow agent safeguards the held back assets, releasing them as authorized by the escrow agreement (typically, upon joint instructions from the escrow parties), and, if the assets are not cash (such as stock), ensuring that valid title is transferred. This is a multi-party arrangement with the escrow agent acting on behalf of all escrow parties in accordance with the escrow agreement.

- The paying agent and/or payment administrator is tasked with verifying and administering the distribution of the escrow accounts to the proper payees at the end of the escrow period. Escrow agents generally will not process multiple wires for escrow releases. Rather, they send the full amount to the paying agent for further distribution and tax reporting. The paying agent is typically the same entity engaged to pay the purchase price to the seller when the deal closes. Consolidating payment roles and processes and selecting experienced providers using efficient technology can save the buyer time, expense, and administrative burden.

- Why does picking the right players matter?

High-touch service is essential to M&A escrow management. Since these escrows hold substantial assets that must be distributed accurately and in a timely fashion, it is critical to select escrow agents and paying agents that are neutral, reputable, financially secure, and accurate. The right paying agent can swiftly gather and administer a large amount of documents and data in a secure database. They can generate tax forms and distribute funds efficiently electronically and by check. Learn more about gaining payment efficiencies with an experienced paying agent.

What to know when negotiating an M&A escrow agreement

Most escrow agents and paying agents have template agreements. However, using their form is negotiable, as are the agreement terms. It is important to understand common terms and conditions to avoid pitfalls and verify that the agreements accurately reflect the agreed deal. To accelerate the negotiating process, SRS Acquiom recommends using the same paying agent used to distribute the purchase proceeds at closing to act as paying agent for the escrow release payments.

Common requirements of M&A escrow agreements

Escrow Agent Protections

Escrow agreements include protections for escrow agents such as indemnities, the ability to rely and act upon instructions, and the course of action if there is a dispute. While these provisions are somewhat negotiable depending on the escrow agent, keep in mind that insufficient provisions will only increase escrow agent exposure and potentially jeopardize the ability to perform the role properly.

Know Your Customer (KYC)

All parties to the escrow agreement are responsible for opening the escrow account and are subject to KYC requirements and the escrow agent’s security procedures. Each party must identify and appoint at least two authorized representatives. Deal parties should be prepared to meet these standard requirements, in advance, to avoid delays in finalizing the agreements and opening the escrow accounts. Asking about specific KYC requirements early and engaging an experienced escrow agent will streamline the process.

Release Instructions

The escrow agreement must clearly state the release requirements and provide unambiguous instructions for the escrow agent to follow. Instructions can take one of three forms - joint written instructions, unilateral instructions, or automatic releases.

- Joint written instructions avoid ambiguity and conflict since both parties must agree. Often the escrow agreement includes a template that provides the information to be included in the instructions, such as the amount to be released, where and to whom to deliver the funds or assets, payment instructions, and tax characterizations. Joint written instructions are the most common release approval method.

- Unilateral instructions allow one of the parties (usually the buyer) to instruct the escrow agent when, how and where to release escrow assets. If they are not very clear, and the other party disagrees with a distribution, the escrow agent could be caught in a dispute, causing a delay.

- Automatic releases direct the escrow agent to release assets upon a certain date. This may not be advisable because the escrow agent may not have received notice of pending claims as of the release date even if the parties agree a contemporaneous copy of all notices must be sent to the escrow agent.

Escrows that include stock

In M&A deals where the purchase price includes both cash and stock, the parties may choose an all-cash escrow or a mix of cash and stock. If there is a mixed escrow, the escrow agreement must specify the holding and payment mechanics for each type of asset and whether distributions are paid first from stock or cash or some proportion of both. Find out more about the many issues to consider when escrowing stock.

Addressing the tax consequences of escrow accounts

Tax strategy and negotiation for M&A deals is critical for all parties and should include understanding the impact of certain escrow account features on each party. Tax and reporting issues related to escrows should be understood and addressed when discussing the amount of the escrow and how it will be invested and released.

For escrow assets held beyond a fiscal year, the deal parties may consider whether the escrow account should be interest bearing and which party owns the account for tax purposes. If there are earnings, either actual or imputed, multiple tax determinations must be made, and taxes may be due. Experienced tax advisors are recommended because the tax rules around escrow account nuances, particularly imputed earnings, are complicated. Neither party wants to be surprised by a tax obligation it was unaware of or that could have been avoided.

Should the escrow account earn interest?

One of the first decisions around taxes is determining if the escrow account will earn interest or investment returns. There is no “right” answer, but the potential earnings over the life of the escrow account must be sufficient to compensate for the additional administrative and tax burden. Besides possibly paying more taxes, if an interest-bearing escrow is chosen, additional mechanics covering tax obligations, reporting, and calculation of amounts to be released must be addressed in the various escrow and paying agent agreements, increasing the cost of administration.

- The potential amount of earnings must offset the additional burdens to be worthwhile.

- Non-interest-bearing escrows are simpler and relieve some of the administrative and tax calculation burdens. Depending on the size and length of the escrow, they may be a good option.

- Whether placed in interest-bearing or non-interest-bearing investments, it is crucial that the escrow assets remain secure and available for release. Investment decisions should be carefully considered by the parties, particularly with respect to risk and liquidity.

Who owns the escrow account for tax purposes?

Another key decision is determining which party owns the escrow account. Often, the buyer is designated as the owner. If the purchase agreement specifies that the buyer is the owner of a non-interest-bearing escrow account, there may be no taxable event during the term of the escrow and no taxes due by either party. This less complicated approach may be preferable in many deals, but early tax planning can help decide the best overall outcome. Learn more about taxation of interest earned on M&A escrow accounts.

Post-closing management of M&A escrows

It is common for an M&A deal to include at least one escrow, so deal parties should prepare for managing them after closing. Whether there is one escrow or several, there are many administrative tasks that must be accomplished to accurately, swiftly, and securely manage escrow accounts and distributions.

As mentioned above, selecting the right partners to assist can make post-closing tasks more efficient and seamless. Experienced escrow agents and paying agents can provide welcome guidance on how to address issues that may arise, but selecting experienced service providers using best-in-class technology tools can significantly reduce the cost of administration and opportunities for delay or error. Top-tier escrow paying agents provide digital services and deploy secure online platforms and technology tools to securely meet administrative challenges. Reviewing a paying agent’s payment platforms and other technological capabilities, along with its personnel and pricing, is highly recommended. SRS Acquiom regularly serves as escrow paying agent and provides its clients with a cost-effective, secure, fully encrypted portal providing real-time information that can be accessed anytime, from anywhere. Learn more information about the paying agent solutions at SRS Acquiom.

M&A escrows are an important risk mitigation tool in almost all M&A deals. Understanding their benefits, what risks they mitigate, and how they can be seamlessly managed is well worth the effort of advance planning. Identify an escrow partner that offers the high-level of escrow management service and security you need for your M&A deal to keep it moving efficiently through post-closing tasks.

Chris is the senior managing director, M&A. In this capacity, Chris has overall responsibility for our M&A products and services, including escrows, payments, and shareholder representation.

Chris has a long history of providing exceptional service to SRS Acquiom clients. For over a decade, Chris worked in the SRS Acquiom Professional Services Group, where he led the teams that handled post-closing escrow claims, earnouts, purchase price adjustments, distributions of shareholder proceeds, and other activities related to serving as shareholder representative. Chris then managed our relationship manager, relationship associate, and deal intake teams, where he worked to ensure that our clients were able to navigate the closing and post-closing escrow and payments process as easily as possible.

Before joining SRS Acquiom, Chris practiced corporate law in the Colorado office of Cooley LLP, where he focused on venture capital transactions and mergers and acquisitions. He began his legal career at Cravath, Swaine & Moore LLP in New York City. At Cravath, he primarily represented underwriters in initial public offerings and high-yield debt offerings and lenders in commercial banking transactions.

Chris is a frequent contributor to M&A thought leadership through his work on SRS Acquiom data studies, articles, and speaking presentations. Chris holds a J.D. from Harvard Law School and a B.A. from Rice University.